Eloro Resources Ltd. Intersects the Longest Zinc Interval to Date at its Iska Iska Project, Potosí Department, Bolivia with 456 Metres Grading 1.72% Zn including 190.5m grading 2.35% Zn in Hole DSB-88

Highlights:

- This intersection in Hole DSB-88 is the longest zinc interval discovered to date at Iska Iska and is also outside the current resource limit further expanding the Silver-Zinc (Ag-Zn) Epithermal Domain located in the eastern margin of the potential Santa Barbara starter pit.

- DSB-89, a step-out hole collared 50m northwest of hole DSB-88, intersected a number of higher grade silver, tin and zinc intervals:

-

- 13.50m grading 74.64 g/t Ag, 0.81% Pb, 0.24% Sn beginning at 50.8m;

- 19.50m grading 41.52 g/t Ag, 0.88% Zn beginning at 74.8m;

- 33.00m grading 28.96 g/t Ag, 0.75% Pb and 2.36% Zn beginning at 103.30m;

- 20.25m grading 19.61 g/t Ag, 1.29% Pb and 2.38% Zn beginning at 136.30m; and

- 24.75m grading 0.45% Pb, 1.80% Zn beginning at 156.55m.

- Further downhole DSB-89 intersected additional higher-grade sections of:

-

- 16.50m grading 81.94 g/t Ag, 1.78% Pb, 1.37% Zn and 0.15% Sn beginning at 392.80m;

- 118.50m grading 0.68% Pb and 1.31% Zn beginning at 200.80m;

- 76.50m grading 38.69g/t Ag, 0.79% Pb and 0.93% Zn beginning at 359.80m and 27.00m grading 49.87g/t Ag, 0.47% Pb and 1.13% Zn beginning at 409.30m;

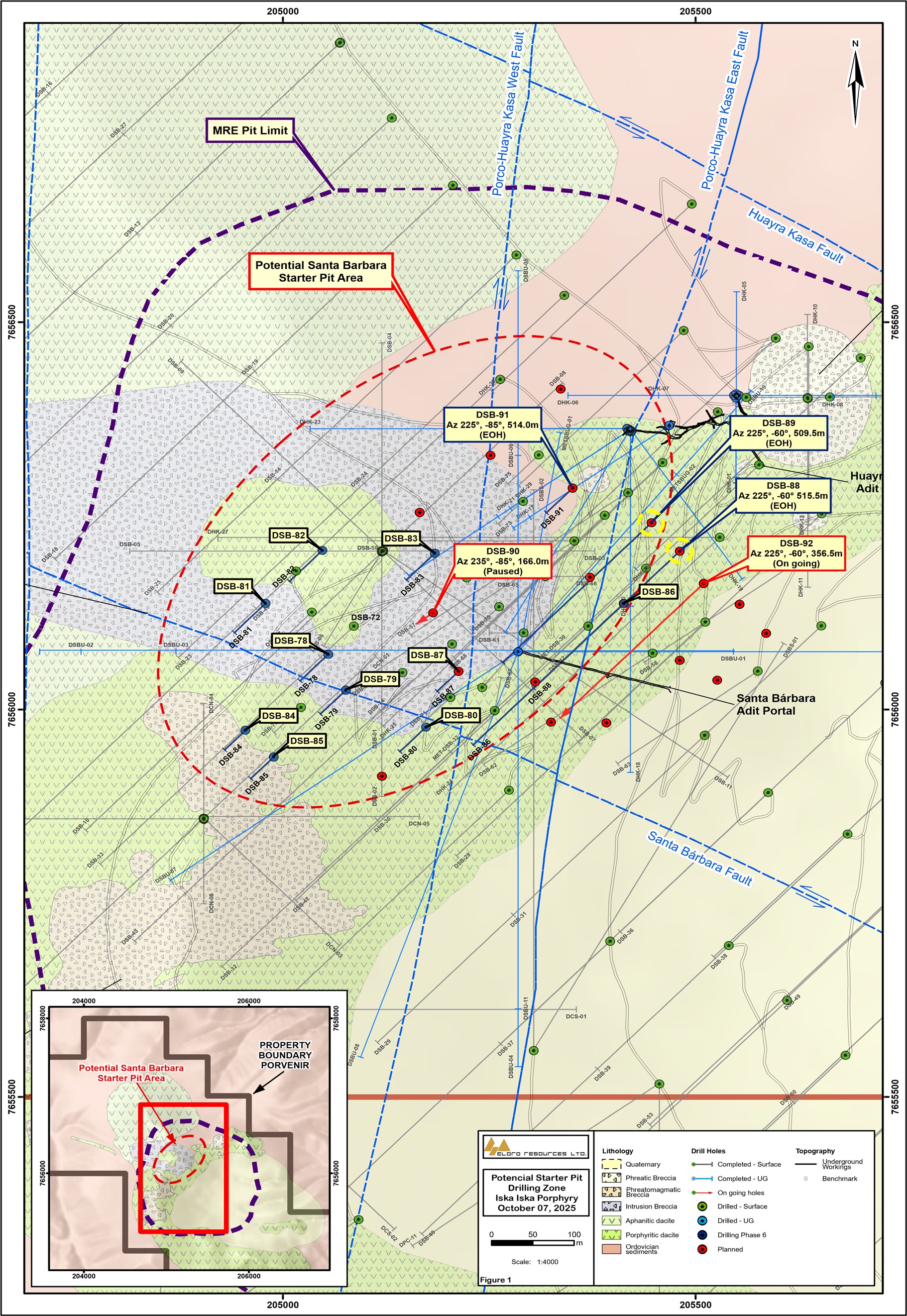

TORONTO, Oct. 09, 2025 (GLOBE NEWSWIRE) -- Eloro Resources Ltd. (TSX: ELO; OTCQX: ELRRF; FSE: P2QM) (“Eloro”, or the “Company”) is pleased to announce further assay results from two (2) step-out drillholes (DSB-88 and DSB-89) of the second phase definition diamond drilling program. Both holes are in the Silver-Zinc-Polymetallic Domain in the potential Santa Barbara starter pit area. These results further expand the footprint of this domain and indicate that the deposit continues to be open to the east (see Figure 1). To date, a total of 6,756m of diamond drilling in fourteen (14) holes has been completed in the current definition drilling phase. A total of 3,371m was completed in the seven (7) reported holes, with assay results pending for one remaining hole totaling 514m in length.

Figure 1 shows the location of drill holes reported, Table 1 lists significant assay results and Table 2 lists drill hole coordinates.

Tom Larsen, Eloro’s CEO commented: “We are encouraged by these latest drill results at the Santa Barbara zone. They are successfully infilling areas that were previously characterized as waste in the Mineral Resource Estimate (MRE) due to a lack of drilling data, and are expected to contribute to both the expansion and upgrading of the mineral resource for the upcoming Preliminary Economic Assessment (PEA).”

Dr. Osvaldo Arce, P.Geo., Eloro’s Executive Vice President Operations, Latin America added: “The definition drill program has been very successful in extending the footprint of both the higher-grade Sn-Ag domain to the west and the higher-grade Ag-Zn-Polymetallic domain to the east, which are controlled by the Porco-Huayra Kasa fault system. Therefore, Iska Iska hosts two giant near surface mineral deposits that remarkably are juxtaposed against each other, hence can be potentially mined from one large starter pit with a relatively low stripping ratio.”

Dr. Arce continued: “The recent intercepts of infill and step-out drilling in the potential starter pit at Santa Barbara zone of 0.51% Sn and 25.46 g/t Ag over 213m within a broader interval of 0.47% Sn and 23.17 g/t Ag over 241.50m in hole DSB-87 (see Eloro’s Press Release dated September 16, 2025) and the current results of 1.72% Zn over 456m in drill hole DSB-88 and of 1.27% Zn, 24.51g/t Ag and 0.54% Pb over 154.50m in drill hole DSB-89 are some of the most robust mineralized intersections to date in the definition drill program at Santa Barbara zone and some of the most significant intersections within the Iska Iska Project. These important results reinforce the exploration strategy of the Eloro technical team.”

Definition Drill Program, Santa Barbara Potential Starter Pit Area

Drillholes DSB-88 and DSB-89 were drilled in the southeastern margin of the potential starter pit area. DSB-88, a step-out hole collared 310.00m northeast of hole DSB-87, intersected the following silver, gold, zinc, lead and tin intervals.

- 25.75 g/t Ag over 6.00m beginning at 50.20m,

-

1.72% Zn over 456.00m beginning at 56.20m including:

- 2.35% Zn over 190.50m beginning at 56.20m,

- 3.63% Zn over 27.00m beginning at 158.20m, and

- 1.79% Zn over 36.00m beginning at 261.70m.

Further downhole, DSB-88 intersected 1.74% Zn over 136.50m beginning at 375.70m, including:

- 1.10 g/t Au, 19.33 g/t Ag, 1,69% Pb, 3.97% Zn and 0.13% Sn over 6.75m beginning at 385.45m and

- 48.50 g/t Ag, 2.00% Pb, 6.02% Zn and 0.18% Sn over 10.50m beginning at 474.70m.

DSB-89, a step-out hole collared 50.00m northwest of hole DSB-88, intersected the following silver, zinc, lead and tin intervals:

-

24.51 g/t Ag and 1.27% Zn over 154.50m beginning at 26.80m, including:

- 74.64 g/t Ag and 0.24% Sn over 13.50m beginning at 50.80m;

- 41.52 g/t Ag over 19.50m beginning at 74.80m;

- 28.96 g/t Ag and 2.36% Zn over 33.00m beginning at 103.30m;

- 19.61 g/t Ag, 1.29% Pb, 2.38% Zn and 0.12% Sn over 20.25m beginning at 136.30m and

- 1.80% Zn over 24.75m beginning at 156.55m. These intervals are within a broader interval of 154.00m grading 1.27% Zn, 24.51g/t Ag and 0.54% Pb beginning at 26.80m

- 1.31% Zn over 118.50m beginning at 200.80m

-

38.69 g/t Ag and 0.93% Zn over 76.50m beginning at 359.80m, including:

- 81.94 g/t Ag, 1.78% Pb, 1.37% Zn and 0.15% Sn over 16.50m beginning at 392.80m; and

- 49.87 g/t Ag and 1.13% Zn over 27.00m beginning at 409.30m.

Further downhole, DSB-89 intersected 1.24% Zn and 0.11% Sn over 4.50m beginning at 479.80m.

Figure 1: Location Map of Definition Diamond Drill Holes, Santa Barbara zone, Iska Iska. The yellow circles highlight the location of holes DSB-88 and DSB-89 referred to in this release.

Table 1: Definition Diamond Drill Results as of October 6, 2025, Santa Barbara, Iska, Iska.

| Hole No. | From (m) | To (m) | Length (m) | Ag | Zn | Pb | Sn | Ag eq. |

| g/t | % | % | % | g/t | ||||

| DSB-88 | 50.20 | 56.20 | 6.00 | 25.75 | 0.09 | 0.20 | 0.04 | 38.06 |

| 56.20 | 512.20 | 456.00 | 5.92 | 1.72 | 0.41 | 0.04 | 79.83 | |

| Incl. | 56.20 | 246.70 | 190.50 | 6.95 | 2.35 | 0.48 | 0.04 | 103.18 |

| Incl. 2 | 158.20 | 185.20 | 27.00 | 8.44 | 3.63 | 0.83 | 0.06 | 160.48 |

| Incl. | 261.70 | 297.70 | 36.00 | 2.84 | 1.79 | 0.50 | 0.04 | 82.14 |

| Incl. | 375.70 | 512.20 | 136.50 | 8.81 | 1.74 | 0.51 | 0.06 | 89.26 |

| Incl. 2 | 385.45* | 392.20 | 6.75 | 19.33 | 3.97 | 1.69 | 0.13 | 213.53 |

| Incl. 2 | 474.70 | 485.20 | 10.50 | 48.50 | 6.02 | 2.00 | 0.18 | 324.57 |

| DSB-89 | 26.80 | 181.30 | 154.50 | 24.51 | 1.27 | 0.54 | 0.09 | 93.75 |

| Incl. | 50.80 | 64.30 | 13.50 | 74.64 | 0.03 | 0.81 | 0.24 | 131.33 |

| Incl. | 74.80 | 94.30 | 19.50 | 41.52 | 0.88 | 0.23 | 0.06 | 83.17 |

| Incl. | 103.30 | 136.30 | 33.00 | 28.96 | 2.36 | 0.75 | 0.09 | 139.82 |

| Incl. | 136.30 | 156.55 | 20.25 | 19.61 | 2.38 | 1.29 | 0.12 | 148.73 |

| Incl. | 156.55 | 181.30 | 24.75 | 4.57 | 1.80 | 0.45 | 0.07 | 88.02 |

| 200.80 | 319.30 | 118.50 | 3.76 | 1.31 | 0.68 | 0.08 | 77.66 | |

| 359.80 | 436.30 | 76.50 | 38.69 | 0.93 | 0.79 | 0.10 | 102.10 | |

| Incl. | 359.80 | 392.80 | 33.00 | 7.91 | 0.56 | 0.57 | 0.10 | 57.77 |

| Incl. | 392.80 | 409.30 | 16.50 | 81.94 | 1.37 | 1.78 | 0.15 | 186.72 |

| Incl. | 409.30 | 436.30 | 27.00 | 49.87 | 1.13 | 0.47 | 0.06 | 104.57 |

| 479.80 | 484.30 | 4.50 | 7.43 | 1.24 | 0.50 | 0.11 | 81.82 | |

Note: True width is approximately 80% of core length. Silver equivalent (Ag eq) grades are calculated using 3-year average metal prices of Ag = US$24.14/oz, Zn = US$1.36/lb , Pb = 0.98/lb and Sn = US$13.74/lb, and preliminary metallurgical recoveries of Ag = 88%, Zn = 87%, Pb= 80% and Sn = 50%. In selecting intervals, a cutoff grade of 30 g Ag eq/t has been used. Lower grade material may be included in intersections where geological continuity is warranted.

*interval also assayed 1.10 g/t Au

Table 2: Summary of Diamond Drill Hole Coordinates for Drill Holes Completed at Iska Iska as of October 6, 2025

| Hole No. | Type | Collar Easting | Collar Northing | Elevation | Azimuth | Angle | Hole length (m) |

| DSB-88 | P | 205481 | 7656205 | 4173 | 225° | -60° | 515.5 |

| DSB-89 | P | 205447 | 7656241 | 4191 | 225° | -60° | 509.5 |

| Subtotal | 1,025 | ||||||

Qualified Person (“QP”)

Dr. Osvaldo Arce, P.Geo. Executive Vice President, Latin America for Eloro and General Manager of Eloro’s Bolivian subsidiary, Minera Tupiza S.R.L, and a Qualified Person (“QP”) as defined by National Instrument (“NI”) 43-101 has reviewed and approved the technical content of this news release. Dr. Arce who has more than 35 years of mineral exploration and extensive mining expertise across several countries in North and South America manages the overall technical program and supervises all field work carried out at Iska Iska.

Eloro utilized both ALS and AHK for drill core analyses, both of whom are major international accredited laboratories. Drill samples sent to ALS were prepared in both ALS Bolivia Ltda’s preparation facility in Oruro, Bolivia and the preparation facility operated by AHK in Tupiza with pulps sent to the main ALS Global laboratory in Lima for analysis. Drill core samples sent to AHK Laboratories are also prepared by AHK in Tupiza with pulps sent to the AHK laboratory in Lima, Peru.

Silver (Ag), zinc (Zn) and lead (Pb) are analyzed by Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) using a four-acid digestion; Sn is analyzed by X-Ray Fluorescence (XRF) and Au is analyzed by fire assay on 50g pulps with an Atomic Absorption Spectroscopy (AAS) finish. AAS measures absorbed light to quantify elements, while ICP, such as ICP-OES or ICP-MS, measure emitted light or ions to determine elements. XRF uses fluorescent X-rays to excite atoms and to emit X-rays that reveal the presence and concentration of tin. Sample size in ICP typically ranges from 100 mg (0.1 g) to 1 g, for AAS, is usually less than 100 mg (0.1 g) and for XRF is ideally below 75 µm.

Check samples between ALS and AHK are regularly done as a QA/QC check. AHK is following the same analytical protocols used as with ALS and with the same QA/QC protocols with the exception of Sn for which a sodium peroxide fusion is used at AHK following by ICP. Check comparisons of Sn results from ALS and ALS indicate no statistically significant difference between results using the two different analytical techniques.

Eloro employs an industry standard QA/QC program with standards, blanks and duplicates inserted into each batch of samples analyzed at both laboratories with selected check samples sent to a separate accredited laboratory. Check results are regularly monitored.

About Iska Iska

The Iska Iska silver-tin polymetallic project is a road accessible, royalty-free property, wholly controlled by the Title Holder, Empresa Minera Villegas S.R.L. and is located 48 km north of Tupiza city, in the Sud Chichas Province of the Department of Potosi in southern Bolivia. Eloro has an option to earn a 100% interest in Iska Iska.

Iska Iska is a major silver-tin polymetallic porphyry-epithermal complex associated with a Miocene possibly collapsed/resurgent caldera, emplaced on Ordovician age rocks with major breccia pipes, dacitic domes and hydrothermal breccias. The caldera is 1.6km by 1.8km in dimension with a vertical extent of at least 1km. Mineralization age is similar to Cerro Rico de Potosí and other major deposits such as San Vicente, Chorolque, Tasna and Tatasi, all located along the same overall geological trend.

Eloro began underground diamond drilling from the Huayra Kasa underground workings at Iska Iska on September 13, 2020. On November 18, 2020, Eloro announced the discovery of a significant breccia pipe with extensive silver polymetallic mineralization just east of the Huayra Kasa underground workings and a high-grade gold-bismuth zone in the underground workings. On November 24, 2020, Eloro announced the discovery of the Santa Barbara Breccia Pipe (SBBP) approximately 150m southwest of the Huayra Kasa underground workings.

Subsequently, on January 26, 2021, Eloro announced significant results from the first drilling at the SBBP including the discovery hole from 0.0m to 257.5m. Subsequent drilling has confirmed the presence of significant values of Ag-Sn polymetallic mineralization in the SBBP and the adjacent Central Breccia Pipe (CBP). A substantive mineralized envelope which is open along strike and down-dip extends around both major breccia pipes. Continuous channel sampling along the walls of the Santa Barbara Adit located to the east of SBBP returned average grades of 164.96 g Ag/t, 0.46%Sn, 3.46% Pb and 0.14% Cu over 166m including 446 g Ag/t, 9.03% Pb and 1.16% Sn over 56.19m. The west end of the adit intersects the end of the SBBP.

Since the initial discovery hole DHK-15 which returned 29.53g Ag/t, 0.078g Au/t, 1.45%Zn, 0.59%Pb, 0.080%Cu and 0.056%Sn over 257.5m, Eloro has released a number of significant drill results in the SBBP and the surrounding mineralized envelope which, along with geophysical data, has defined an extensive target zone. On October 17, 2023, Eloro filed the NI 43-101 Technical Report outlining the initial inferred MRE for Iska Iska, prepared by independent consultants Micon International Limited. The MRE was reported in two domains, the Polymetallic (Ag-Zn-Pb) Domain which is primarily in the east and south of the Santa Barbara deposit and the Tin (Sn-Ag-Pb) Domain which is primarily in the west and north.

The Polymetallic Domain is estimated to contain 560Mt of inferred mineral resources at 13.8 g Ag/t, 0.73% Zn & 0.28% Pb at an NSR cutoff of US$9.20 for potential open pit and an NSR cutoff of US$34.40 for potential underground. The majority of the mineral resource is contained in the constraining pit which has a stripping ratio of 1:1. The Polymetallic Domain contains a higher-grade inferred mineral resource at a NSR cutoff of $US25/t of 132 million tonnes at 1.11% Zn, 0.50% Pb and 24.3 g Ag/t which has a net NSR value of US$34.40/t which is 3.75 the estimated operating cost of US$9.20/t. The Tin Domain which is adjacent to the Polymetallic Domain and does not overlap, is estimated to contain an inferred mineral resource of 110Mt at 0.12% Sn, 14.2 g Ag/t and 0.14% Pb but is very under drilled.

Results of the definition drill program which totalled 5,267.7m in 11 holes were reported on December 18, 2023 and January 11, 2024, respectively. Significant results included 279.22 g Ag/t, 0.47% Pb and 0.43% Sn (339.82g Ag eq/t) over 62.84m and 33.83 g Ag/t, 1.53% Zn, 0.93% Pb and 0.14% Sn (130.88g Ag eq/t) over 178.99m including 120.37 g Ag/t, 2.13% Zn, 1.57% Pb and 0.19% Sn in hole DSB-61; 57.62g Ag/t, 1.26% Zn, 0.94% Pb and 0.12% Sn (139.94g Ag eq/t) over 136.11m in hole DSB-66 and 118.86g Ag/t, 0.35% Zn, 0.35% Pb and 0.15% Sn (152.29g Ag eq/t) over 81.28m in hole DSB-65. This latter intersection in hole DSB-65 included a very high-grade sample of 5,080g Ag/t, 0.12 g Au/t, 0.26% Zn, 1.34% Pb, 1.53% Cu and 1.27% Sn (4,746.46g Ag eq/t) over 1.46m.

Metallurgical tests reported on January 23, 2024 from a 6.3 tonne PQ drill core bulk sample representative of the higher grade Polymetallic (Ag-Zn-Pb) Domain returned a significantly higher average silver value of 91 g Ag/t compared to the weighted average grade of the original twinned holes at 31 g Ag/t strongly suggesting that the average silver grade is likely significantly underreported in the original twinned holes due to the much smaller sample size.

On January 29, 2024, the Company reported that the new chargeability high outlined southeast of the MRE open pit by the expanded induced polarization (IP) survey indicates that the major mineralized structural corridor that is up to 800m wide extends a further 600m along strike to the southeast for an overall strike length of at least 2km. This new area has not been drilled.

The Company reported on July 30, 2024, that updated modelling of the potential starter pit area at Santa Barbara zone highlights the importance of completing additional drilling to better define the grade and extent of the mineral resource in this area. Areas with higher-grade resource typically have much better drilling density but holes outside the core potential pit area are too widely spaced to give an accurate estimate of grade.

On September 4, 2024, the Company announced the restart of definition drilling in the potential starter pit area at Santa Barbara. Previous drilling has shown that areas with high-grade mineralization typically have much better drilling density, whereas holes outside the core area are too widely spaced to give an accurate grade estimate. This increased drilling density is particularly important for defining the extent of the high-grade Ag-bearing and Sn-bearing structures, and for categorizing the mineral resources from inferred to indicated, which have a major influence on overall grade and resources that will contribute to the preliminary economic assessment (“PEA”).

Results from the first definition drill hole DSB-68 were released on November 26, 2024. This hole intersected 66.90g Ag/t, 0.63% Zn, 0.42% Pb and 0.11% Sn (111.14g Ag eq/t) over 289.13m including higher grade intervals of:

- 126.10g Ag/t, 0.55% Zn, 0.60% Pb and 0.09% Sn (160.72g Ag eq/t) over 122.03m,

- 47.61g Ag/t, 0.22% Zn, 0.40% Pb and 0.45% Sn (146.06g Ag eq/t) over 16.51m, and

- 25.52g Ag/t, 2.19% Zn, 0.65% Pb and 0.10% Sn (129.60g Ag eq/t) over 7.46m

Further drill results were released on January 6, 2025:

- Hole DSB-69 intersected 127.49g Ag/t, 0.50% Zn, 0.16% Pb and 0.31% Sn (193.00g Ag eq/t) over 41.25m within a broader interval of 49.71g Ag/t, 0.78% Zn, 0.32% Pb and 0.15% Sn (106.97g Ag eq/t) over 142.50m.

- Hole DSB-70 intersected, 45.71g Ag/t, 3.11% Zn, 1.91% Pb and 0.23% Sn (232.35g Ag eq/t) over 81.00m within a broader interval of 30.08g Ag/t, 1.63% Zn 0.98% Pb and 0.13% Sn (127.89g Ag eq/t) over 255.75m

- Hole DSB-71 intersected 53.17 Ag/t, 0.72% Zn, 0.40% Pb and 0.19% Sn (116.62 g Ag eq/t) over 45.00m within a broader interval of 29.26 Ag/t, 0.58% Zn, 0.22% Pb and 0.11% Sn (71.46g Ag eq/t) over 127.50m.

On January 23, 2025, the Company reported discovery hole DSB-72 that opens up a major tin zone intersecting 33m grading 1.39% Sn within 87m grading 0.74% Sn. Tin mineralization is hosted in an extensive intrusion breccia unit (TIB) that is approximately 750m long by 450m wide and extends to a depth of at least 700m. Previous wide space reconnaissance drilling has intersected a number of significant Sn intersections in this breccia unit which is very under-drilled.

Higher grade tin mineralization in Hole DSB-72 occurs as visible coarse and medium-grained high temperature cassiterite which is likely to be amenable to multi-gravity separation. Core from this hole will be used for additional metallurgical testing. Geophysically, the intrusion breccia has low chargeability which contrasts considerably with the adjacent later epithermal Ag-Zn-Pb mineralization which is marked by a strong chargeability anomaly. The intrusive breccia is very likely an offshoot or apophysis from a large tin porphyry at depth. The likely top of this tin porphyry is marked by a highly conductive zone that is interpreted as a pyrite-pyrrhotite halo around this porphyry. Similar pyritic halos have been reported from other major tin deposits in the Bolivian Tin Belt.

With this discovery of a presumed shallow level apophysis of a tin porphyry at depth, Eloro is in a unique position of having two discernable different deposit styles juxtaposed against one another; a very large silver-zinc-lead dominant system next to a high-grade tin system. While these two systems are likely genetically related, this means that the Company may potentially have two giant deposits on the same property.

About Eloro Resources Ltd.

Eloro is an exploration and mine development company with a portfolio of precious and base-metal properties in Bolivia, Peru and Quebec. Eloro has an option to acquire a 100% interest in the highly prospective Iska Iska Property, which can be classified as a polymetallic epithermal-porphyry complex, a significant mineral deposit type in the Potosi Department, in southern Bolivia. A NI 43-101 Technical Report on Iska Iska, which was completed by Micon International Limited, is available on Eloro’s website and under its filings on SEDAR+. Iska Iska is a road-accessible, royalty-free property. Eloro also owns an 82% interest in the La Victoria Gold/Silver Project, located in the North-Central Mineral Belt of Peru some 50 km south of the Lagunas Norte Gold Mine and the La Arena Gold Mine.

For further information please contact either Thomas G. Larsen, Chairman and CEO or Jorge Estepa, Vice-President at (416) 868-9168.

Information in this news release may contain forward-looking information. Statements containing forward-looking information express, as at the date of this news release, the Company’s plans, estimates, forecasts, projections, expectations, or beliefs as to future events or results and are believed to be reasonable based on information currently available to the Company. There can be no assurance that forward-looking statements will prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements. Readers should not place undue reliance on forward-looking information.

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/df33a70f-67df-478a-ab4e-2a33b0fc8a23

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.